How often should you meet your financial advisor?

- Owen

- Nov 7, 2012

- 3 min read

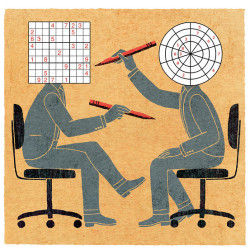

How often to meet your advisor is a question on which everyone has a different opinion.

The short answer, really is, "it depends." There isn't a one-size-fits-all approach.

Sometimes it depends on the client and sometimes on the advisor.

We do like to be in contact with many clients once per quarter, perhaps via a call, zoom videoconference, coffee, lunch or formal meeting.

For many, however, that is too much. A longer semi-annual or annual conversation is their style.

Here are a few thoughts on meeting with your advisor, that you might not expect.

If you aim quarterly, it will often ends up less. For many expatriates, being busy and travelling a lot is pretty common. Local holidays regularly pop up. So many clients who aim for quarterly contact, end up meeting 3 times per year. If your situation is complex or you're taking a more active and/or risk based approach to your portfolio, this might make sense.

Not every meeting is a full financial review. Touching base to discuss a particular component of your portfolio, that your career gives you an insight into, is not the same as a full review. We have clients in retail and the EV space that have excellent industry knowledge that helps us (and them) find new emerging companies with great potential. It has generated us several 'home run' investments over the years. A full review of your financial situation might only need to be done every 1-2 years or even less. Meetings should focus on your needs but also opportunities.

Passive approaches work well, but require fewer portfolio adjustments. Portfolio churn and "being active for the sake of looking active", traps many new and insecure financial advisors. Over-active changes often damage portfolio returns. This happens by selling after a sectoral or market-wide decline. Usually just when you should be buying. It also happens by chasing the hot trend that is just about to fizzle. Just because you contact your advisor a few times a year you don't need to re-adjust all your portfolio holdings at each meeting. In other words: always remember to stick to your plan.

Not every meeting is about your portfolio. This might surprise you, but getting to understand all of a person's thoughts, fears, goals and preferences is not neatly achieved in a 30 minute fact-find. Even after more than a decade as an advisor, it is still surprising to me to discuss that a client I've known for years has a strongly held preference or secret knowledge area that could benefit their portfolio.

Investing is a team sport. It is remarkable to us, about how few couples decide to have both spouses at meetings. To us it makes perfect sense. If you are planning for the family's future, it helps to have both spouses work together. If one spouse is travelling relentlessly, the other might be available for interim reviews or to act as a contact point for urgent matters. If the non-working spouse feels unfamiliar with financial and investing matters, then why not take the opportunity to skill up?

Ultimately, how you approach meetings with your advisor depends on the complexity of your situation, your risk profile, time availability, level of engagement to name a few.

The bottom-line however is: discuss with your advisor and decide on your plan.

You should always feel able to reach out to book a conversation. Either to review or around particular topics. If this makes you uncomfortable because you get the feeling your advisor doesn't like hearing from you, then perhaps it is time to look further afield. Time to click on the "contact us" link above.

Comments